“I'm just going to wait for the market to drop before I buy.”

“Interest rates are too high right now—I’ll invest later.”

“There’s too much uncertainty.”

Sound familiar?

These are the most common statements I hear from people who want to become property investors but end up sitting on the sidelines. Waiting. Watching. Hesitating. Hoping for the “perfect time.”

But here’s the reality: waiting is one of the most expensive decisions an investor can make.

Let’s break down why that is—with real numbers, long-term strategic thinking, and some insight you won’t find on the average real estate blog.

The Illusion of “Perfect Timing”

It’s completely understandable to want to “time the market.” In fact, it’s natural. We’re wired to avoid risk and seek certainty. But here’s the truth every seasoned investor learns:

Trying to time the market is not a strategy—it’s a gamble.

Markets move in cycles, yes. But predicting when they’ll hit their peaks or troughs is almost impossible. Even professional economists get it wrong. And by the time the media headlines start saying “it’s time to buy,” the opportunity has often already passed.

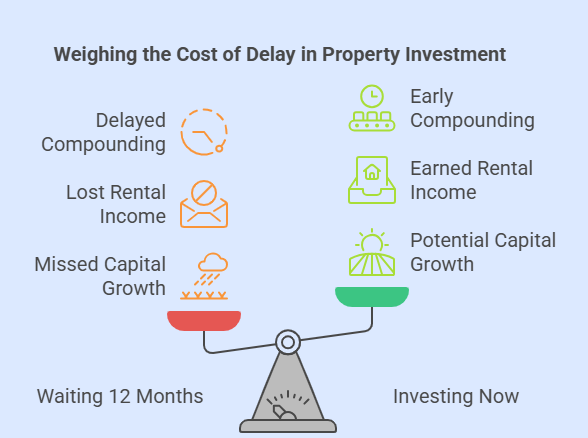

The Real Cost of Waiting

Let’s say you're eyeing a $700,000 investment property in a high-growth suburb in Brisbane. You decide to wait 12 months “just to see what happens.” Here's what that decision might cost you:

➜ Missed Capital Growth

Let’s assume the market grows modestly at 6% in the next year (well within reach in many suburbs even today). That same $700,000 property could be worth $742,000 in 12 months.

Cost of waiting: $42,000 in missed equity.

And remember, capital growth compounds. That $42,000 doesn't just disappear—it could have become the foundation for your next deposit, or significantly improved your loan-to-value ratio (LVR).

➜ Lost Rental Income

Assume that same property generates $650 per week in rental income. Over a year, that’s around $33,800 in gross rent. Even if you deduct expenses and interest, you’re potentially leaving $10,000–$15,000 net cash flow on the table.

➜ Delayed Compounding

Every year you delay getting into the market is one less year for your asset to grow. Property investing is a long game—and time in the market beats timing the market. The earlier you start, the longer your investment has to work for you.

The Risk of Doing Nothing

The biggest trap I see new investors fall into is analysis paralysis. They overthink, overresearch, and end up doing nothing. And while waiting might feel like the safer choice, inaction is a risk in itself—just a slower, quieter one. Here’s what not investing costs you:

List of Services

-

Lost Leverage OpportunitiesList Item 1

With $100,000, you can control a $500,000–$700,000 asset with the right finance. That’s the power of leverage—and it works best when you're in the market.

-

Inflation ErosionList Item 2

Sitting on cash while property prices rise means your buying power is actually shrinking.

-

Emotional FatigueList Item 3

The longer you wait, the harder it gets to pull the trigger. You get caught in a loop of “maybe next year,” while prices keep climbing and opportunities vanish.

But What About High Interest Rates?

This is the other big concern I hear, and it’s valid. Yes, interest rates have increased—and that has impacted borrowing power. But it’s not a reason to sit back and do nothing.

Here’s why:

- Markets adjust. Property prices often soften or stabilize when interest rates rise, which can create buying opportunities.

- You can refinance later. Buy at today’s prices, and refinance into a better rate when the cycle turns. Meanwhile, you’ve locked in the asset at a lower price.

- Rental markets are tight. Vacancy rates are low across many regions, and rents are rising—which can help offset your holding costs.

Smart investors use higher rate environments to enter the market while competition is down, not wait until everyone else rushes back in.

What Experienced Investors Know (That Newbies Often Don’t)

The best investors we work with—many of whom started with just one property—understand these core principles:

- You don’t need the perfect property. You need the right strategy.

Most people are chasing unicorns. A-grade, under-market-value, positive-cashflow, ready-to-develop homes in the best suburb... for a steal. Good luck. Instead, top investors buy strategically sound properties that fit a long-term portfolio plan. - Every property is a stepping stone.

Your first deal won’t make you a millionaire—but it will get you in the game. From there, you build momentum, equity, experience, and leverage. - They act when others hesitate.

Warren Buffett’s famous quote applies just as much to real estate:

“Be fearful when others are greedy, and greedy when others are fearful.”

In uncertain times, experienced investors know it’s not about finding the perfect moment—it’s about buying the right asset in a proven area, based on fundamentals, not feelings.

So When Is the Right Time to Buy?

The truth is, there’s rarely a moment when everything aligns perfectly—when prices are low, interest rates are ideal, lending is easy, and competition is minimal. Waiting for that golden window is like waiting for all the traffic lights on your drive to turn green at once. You’ll never leave the driveway.

The right time to buy is when you are financially prepared, educated on your options, and backed by a clear strategy. Market conditions matter, of course—but far less than your personal readiness and ability to act decisively when opportunity appears.

Successful property investors don’t chase timing. They build a plan and execute it, regardless of noise.

How Living Property Helps You Move from Idea to Execution

Most people want to invest in property—few know how to turn that intention into action. That’s where Living Property steps in. We’re not just buyer’s agents; we’re long-term partners in your investment journey. From clarifying your goals to sourcing high-quality, off-market deals, we help you make confident, data-driven decisions—backed by strategy, not hype. Whether you’re buying your first property or scaling a portfolio, we’ll guide you every step of the way with insight, experience, and a plan built around you.

Let’s Take Action Together

If you’ve been sitting on the fence, this is your sign to get moving. The market isn’t going to wait—and neither should you.

📞 Book your Discovery Call now and we’ll review your current situation, clarify your goals, and map out a pathway to your next (or first) investment.

Don’t let “waiting” cost you another year. Get in the game. Make a move. Build your future—strategically.

Start With An Obligation Free Consltation

Our Obligation Free Consultations are designed for you to ask us anything you like and start the process of uncovering a strategy suited to your circumstances.