The Allure of the “Next Hotspot”

Every investor dreams of finding the next “boomtown”—the suburb or area where property values soar and rental yields follow suit. The appeal is obvious: buying early in an emerging hotspot can lead to massive financial gains. But while rapid growth is enticing, it also carries risks. Not every boom is sustainable, and many investors who rush into emerging areas end up with properties that lose value as the market corrects.

How can you identify which hotspots will stand the test of time, and which ones are destined for a bust? Let’s dive into how to spot the signs of a lasting boom, the metrics that matter, and how to assess a suburb's long-term potential—whether you're a beginner or a seasoned investor.

What Makes a Suburb a “Boomtown” (And Why You Should Be Cautious)

"Boomtown" describes areas experiencing rapid growth, often due to new infrastructure, an influx of residents, or government incentives. The signs of a boomtown include:

- Rapid property price increases: Prices skyrocket seemingly overnight.

- Media buzz: Newspapers and social media hype up the area’s potential.

- New infrastructure projects: Developments like train stations, schools, or hospitals signal growth.

However, these booms can often be driven by speculation rather than solid, long-term fundamentals. Many areas see a rapid price increase only to crash when the hype fades. For example, mining towns during commodity booms and urban fringe suburbs that see a sudden price spike due to accessibility improvements can be victims of unsustainable growth.

Key Indicators of a Viable Long-Term Suburb

To avoid falling into the trap of speculative markets, focus on the fundamentals that will drive long-term growth. Instead of jumping on the media bandwagon, successful investors look for areas with strong, sustainable growth drivers.

List of Services

-

Economic StrengthList Item 1

A suburb’s long-term viability is closely linked to its economic fundamentals. Suburbs with diverse and stable economies, rather than relying on a single industry, are more likely to experience sustained growth. While areas fueled by mining or construction booms may show short-term growth, they are highly vulnerable to economic downturns.

Key Indicators:

- Job growth across various sectors (healthcare, education, retail, etc.)

- Strong investment from businesses or government initiatives

-

Infrastructure and ConnectivityList Item 2

Investing in suburbs with good connectivity to major business hubs or transport nodes is key. Areas with new or planned transport infrastructure, such as train lines, roads, or public transport hubs, tend to attract more people and remain in demand for both renting and purchasing properties.

Key Indicators:

- Existing and planned transport links

- Developments in amenities such as schools, hospitals, or shopping centres

-

Population and DemographicsList Item 3

Look for suburbs that are experiencing strong and diverse population growth. Areas that attract a mix of young professionals, families, and retirees are typically more resilient. If the population is growing steadily, the demand for housing—whether for rent or purchase—remains strong.

Key Indicators:

- Population growth rate

- Demographic shifts (e.g., increasing families or young professionals)

-

Supply vs. DemandList Item 4

The right balance of supply and demand is crucial. An oversupply of properties can lead to stagnation in prices. Suburbs that see too much development in a short time may become flooded, lowering both property values and rental yields.

Key Indicators:

- Building approvals and planned developments

- Developer activity and the rate of property absorption

The Metrics That Matter: How to Spot Long-Term Potential

When assessing a suburb’s growth potential, avoid relying solely on headlines or media coverage. The most important metrics to look at are:

- Median property prices: While these give a snapshot of current market values, they can be distorted in fast-growing areas, especially if early sales are outliers.

- Sales volume: A higher volume of property sales indicates confidence in the market.

- Rental yields: Strong rental yields show that demand for properties is high, and can signal that a suburb is a good long-term investment.

Be cautious about relying too much on short-term price increases or speculative advice. Look for areas with consistent, long-term demand and strong fundamentals.

Timing the Suburb, Not the Market

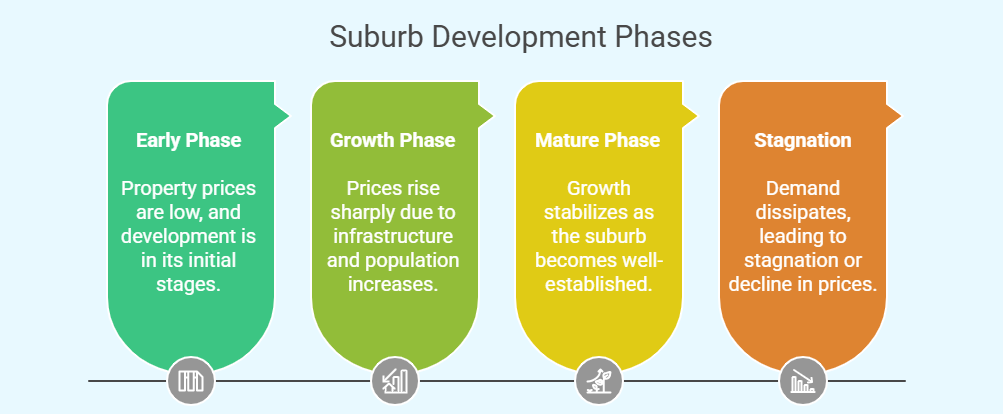

Trying to time the entire property market can be a fool’s errand. However, timing the suburb is more manageable. Suburbs typically go through different phases:

Successful investors buy in during the early-to-mid phases and hold for the long term. Understanding where a suburb is in this cycle is essential for avoiding getting caught at the top of a market.

Red Flags: How to Spot a Bust Before It Happens

Not all boomtowns will maintain their growth. Keep an eye on these signs that an area’s growth may be unsustainable:

- Declining rents: A fall in rental prices can signal that tenant demand is waning.

- Investor oversaturation: If too many investors are buying in, it could flood the market and depress values.

- Infrastructure delays: If promised infrastructure projects are stalled or cancelled, demand could falter.

Being aware of these signs early on allows you to take action and minimize your exposure to risky investments.

Final Advice: Think Long-Term, Not Short-Term

The key to successful property investing lies in making informed, strategic decisions based on long-term fundamentals. While hotspots can deliver significant returns, focusing on areas with solid economic drivers, infrastructure, and population growth will always outperform speculative trends.

Ready to Find Your Next Smart Investment?

If you’re ready to make smarter, more informed property investments, it’s time to look beyond the hype and focus on the fundamentals that will deliver long-term value.

Book your Discovery Call Session with Living Property today. Our expert team can help you navigate the market, identify high-potential areas, and develop a strategy that aligns with your investment goals.

Start With An Obligation Free Consltation

Our Obligation Free Consultations are designed for you to ask us anything you like and start the process of uncovering a strategy suited to your circumstances.