Introduction: The Untapped Potential of Renovation Inside Your SMSF

Renovating investment property is one of the most powerful ways to accelerate capital growth and improve rental yields. It’s a tried-and-tested strategy used by seasoned investors to unlock value, attract quality tenants, and grow equity faster. But when your investment property sits inside a Self-Managed Super Fund (SMSF), things get more complex.

Strict compliance rules govern what you can and can’t do within an SMSF—especially when it comes to renovations, improvements, and property upgrades. Missteps here can have serious consequences, including penalties and non-compliance with superannuation law.

But when executed correctly, renovations within your SMSF can be a strategic, long-term wealth-building play. In this article, we’ll break down how to do it legally, strategically, and in a way that aligns with your retirement goals—whether you're just starting your SMSF journey or looking to fine-tune your portfolio.

Why Renovate? The Strategic Role of Improvements in SMSF Property Growth

SMSFs are designed to grow your retirement savings, and property has become an increasingly popular asset class within them. But simply holding a property in your fund isn’t enough to maximise its performance. Smart investors use value-adding strategies—like targeted renovations—to boost returns.

Done right, renovations can:

✔ Increase rental income and reduce vacancy.

✔ Lift the property's valuation, improving your net asset position.

✔ Improve depreciation benefits and tax efficiency.

✔ Enhance tenant quality and retention.

The catch? Inside an SMSF, these renovations must strictly serve the sole purpose of retirement benefit. This means every dollar spent should improve the investment’s long-term performance—not personal enjoyment or emotional attachment.

Renovation vs. Improvement: Know the Legal Boundaries

This is where many investors get tripped up. The ATO makes a clear distinction between:

- Repairs and maintenance – These are allowed within an SMSF (even if the property was acquired under a loan).

- Improvements – These are restricted if the property was purchased using a Limited Recourse Borrowing Arrangement (LRBA).

Repairs restore something to its original state—like replacing a damaged fence, fixing a leaking roof, or repainting peeling walls. These are fine, even under an LRBA.

Improvements, on the other hand, go beyond the original condition of the property. Adding an extra bathroom, extending the kitchen, or converting a garage into a bedroom—all fall into this category and could breach super laws if financed with borrowed funds.

The key takeaway: If your SMSF used a loan to acquire the property, don’t use borrowed funds for improvements. Repairs? Yes. Enhancements? Only from SMSF cash or after the loan is repaid.

Renovating Without Borrowing: Using SMSF Cash Flow Strategically

Here’s the workaround smart trustees use: fund renovations with available SMSF cash—not borrowed money. If the fund has sufficient liquidity, and the improvements align with the investment strategy, you can legally enhance the asset’s value.

A few smart moves:

- Maintain healthy cash reserves in your SMSF for future upgrades.

- Ensure your trust deed and investment strategy explicitly allow for improvements.

- Always record trustee resolutions, budgets, and project justifications.

This is also a great opportunity to consult your accountant or SMSF specialist. Planning ahead with professional advice can mean the difference between a compliant upgrade—and a costly mistake.

Compliance Comes First: The Sole Purpose Test and Arm’s-Length Rules

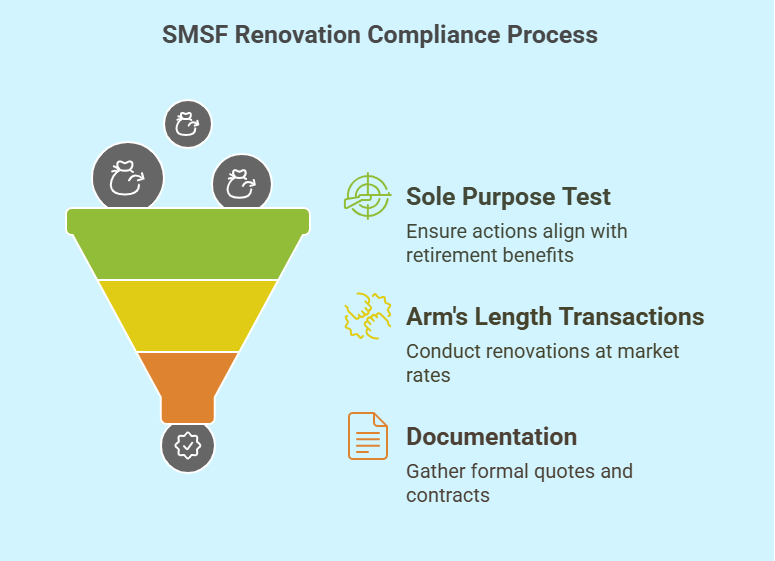

Even if you fund the renovations correctly, the work itself must pass two key compliance tests:

1. The Sole Purpose Test – Every action must serve your SMSF’s goal: providing retirement benefits. No personal use. No side deals. No renovations to suit your taste.

2. Arm’s-Length Transactions – Renovation works must be conducted at market rates, by unrelated third-party contractors. Using your brother-in-law’s tiling business at a discount? That’s a red flag.

You’ll need formal quotes, market comparisons, proper contracts, and payment evidence to prove everything was done at arm’s length. The ATO is increasingly vigilant in this area—so documentation is not optional, it’s essential.

High-Impact Value-Add Strategies That Work Inside SMSFs

List of Services

-

✅ Cosmetic UpgradesList Item 1

Include painting, new carpets, updated lighting, or landscaping. These can drastically improve tenant appeal and are often classed as repairs.

-

✅ Maintenance and RepairsList Item 2

Maintenance and repairs that also boost depreciation—like replacing aging appliances or fixing cracked tiles.

-

✅ Deferred maintenanceList Item 3

Protects the asset’s long-term value, such as gutter replacements or termite treatments.

When to Renovate: Timing is Everything

Timing your renovation can dramatically affect both compliance and return on investment. For example:

- Wait until the LRBA loan is fully repaid before making significant improvements.

- Time cosmetic upgrades during a vacancy or between tenancies.

- Renovate before a revaluation to help improve your SMSF’s borrowing capacity or liquidity position.

- Upgrade before listing a property for sale to enhance sale price and appeal.

Strategic timing is how seasoned investors turn basic properties into outperformers—without falling foul of SMSF rules.

Conclusion: Renovation Is a Smart Play—If You Know the Rules

Renovating inside your SMSF can be a powerful lever for long-term growth—but only if it’s done within the legal and strategic boundaries. Understanding the fine line between repairs and improvements, using SMSF cash wisely, and staying 100% compliant will protect your fund and position you for greater returns.

Whether you’re a new trustee exploring SMSF property for the first time, or an experienced investor looking to optimise returns—smart renovation can be your edge.

Call to Action: Want to Renovate Smartly Within Your SMSF?

At Living Property, we help SMSF investors navigate the complex world of real estate acquisition, strategy, and renovation—with full compliance and confidence. We’re here to help you plan it right from the start. Book your Discovery Call with us! Let’s make sure your next renovation drives performance—not problems.

Start With An Obligation Free Consltation

Our Obligation Free Consultations are designed for you to ask us anything you like and start the process of uncovering a strategy suited to your circumstances.