Accelerated Growth Without More Contributions

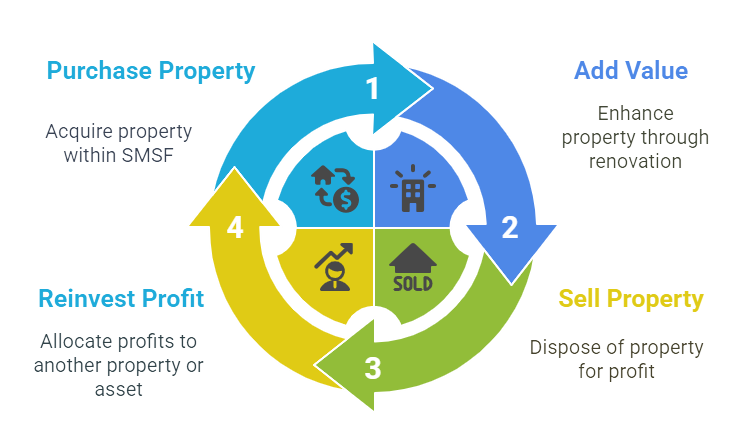

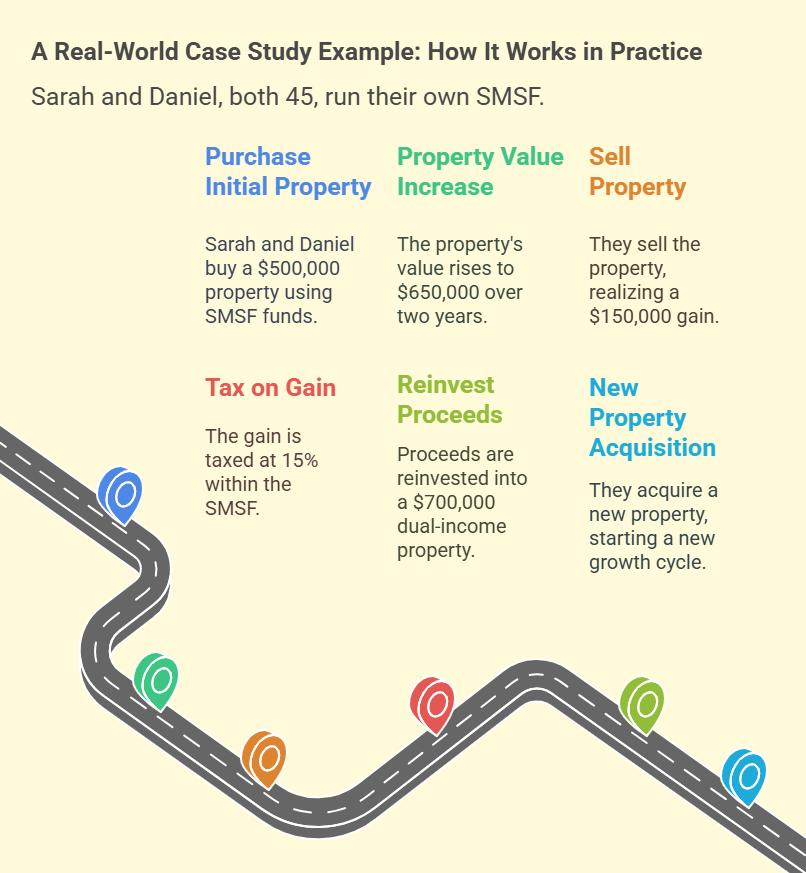

With caps on concessional (tax-deductible) and non-concessional (after-tax) contributions tightening, many investors hit a ceiling on how much they can add to super each year. Property recycling is a way to increase your SMSF’s capital base without needing to tip in more from your personal income.

Compounding Gains Inside a Low-Tax Environment

All profits made within the SMSF are taxed at a maximum of 15% during the accumulation phase and 0% in retirement phase. That’s far more tax-efficient than holding the same asset in your personal name, especially when buying, improving, and selling for capital gains.

Better Cash Flow in Retirement

Each time you upgrade the type or quality of property held, you improve the long-term income stream your SMSF can generate. By the time you hit pension phase, you’re holding stronger-performing assets that support a better standard of living in retirement.