"If you own a home, you may be sitting on a goldmine—and not even know it."

While most Australians focus on paying down their mortgage, many overlook one of the most powerful tools in wealth-building: equity. Not just the equity you think you have—but the usable equity that can fund your next investment property, boost your super, and fast-track your financial freedom.

But here’s the thing—equity alone doesn’t build wealth. Knowing how to use it does.

Let’s break down the mechanics of equity: how to calculate it accurately, how to use it strategically, and how to manage the risk so you can move forward with confidence.

What Is Equity—Really?

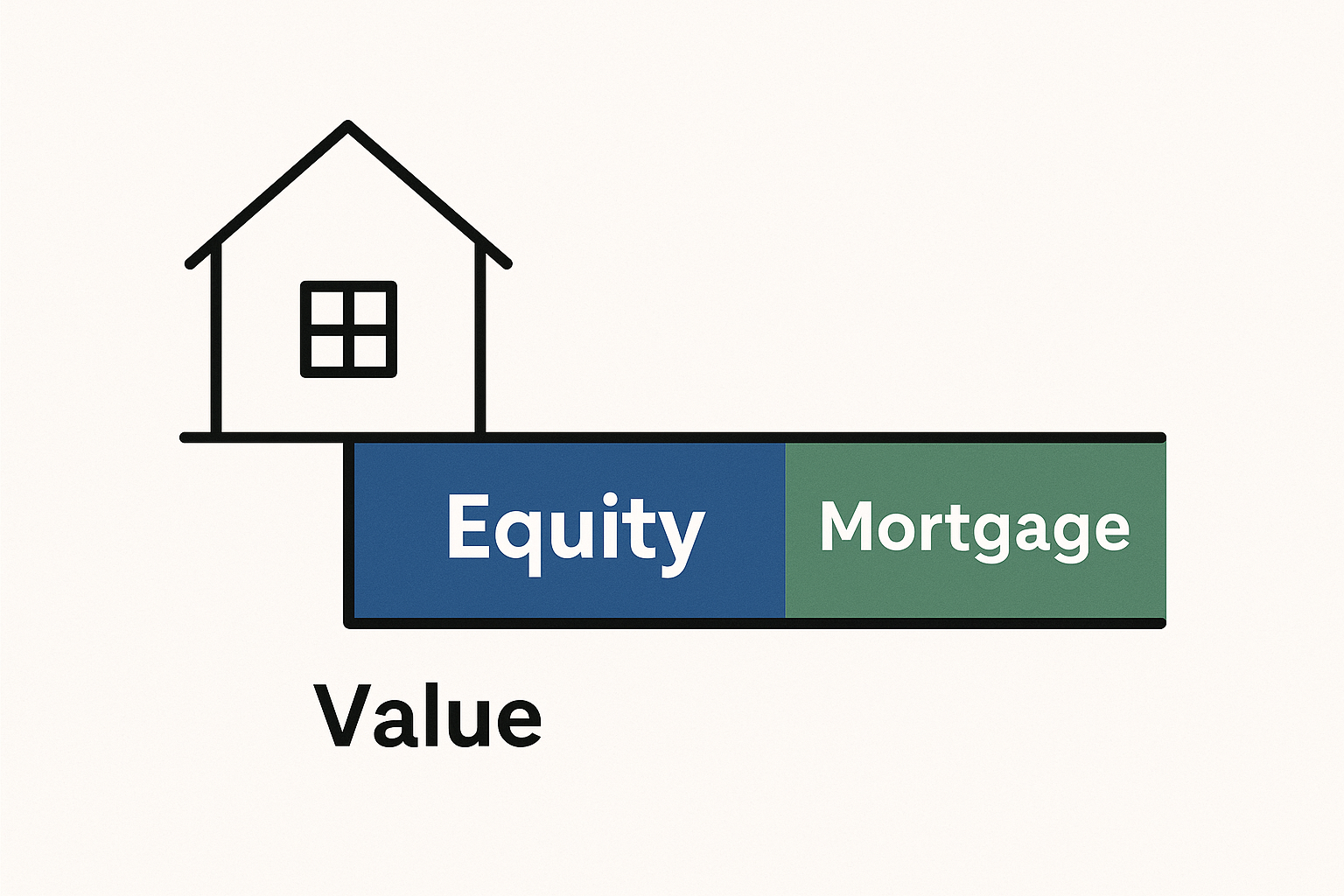

Put simply, equity is the difference between what your property is worth and what you owe on your mortgage.

But there are two kinds of equity:

🔵 Total equity: The full gap between your property’s market value and your loan.

🔵 Usable equity: The amount a lender will actually let you access—usually up to 80% of the property value (sometimes more, depending on your loan strategy).

Here’s an example:

Property value: $800,000

🔵 Outstanding loan: $400,000

🔵 80% of value: $640,000

🔵 Usable equity = $640,000 - $400,000 = $240,000

That $240K isn’t just numbers on a spreadsheet. It’s your wealth potential—if you know how to use it right.

How to Use Your Equity Strategically

Think of equity as your springboard—it can help you:

✅ Buy an investment property without saving a cash deposit

✅

Boost your super through concessional or non-concessional contributions

✅

Renovate to increase rental returns or property value

✅

Consolidate higher-interest debt for better cash flow

But it’s not about doing everything. It’s about choosing the strategy that fits your stage of life, risk profile, and financial goals.

"It’s about choosing the strategy that fits your stage of life, risk profile, and financial goals."

Managing the Risk: Equity Isn’t Free Money

Yes, equity can create wealth. But accessing it increases your debt, so you need to be smart about how you structure the loan and what you use it for.

Here’s how seasoned investors reduce risk while leveraging equity:

1. Have a Buffer

Don’t use every cent of your usable equity. Leave room for emergencies, interest rate changes, or vacancy periods. A safety buffer keeps your investment sustainable.

2. Focus on Income-Producing Assets

Using equity to buy assets that grow in value and produce cash flow (like property) is very different from spending it on a new car. Stick to assets that work for you.

3. Structure Loans Correctly

Split your loan. Keep your home loan separate from your investment loan. Make sure your accountant and mortgage broker are on the same page—this affects tax deductions.

4. Know Your Exit Plan

What’s your goal? Early retirement? Passive income? Lifestyle flexibility? Using equity isn’t just about growing fast—it’s about growing with a purpose.

Real Example: From Equity to Portfolio

Let’s take Jason and Mel, a couple in their late 30s.

🔵 Their home in Melbourne is worth $900K, loan down to $430K

🔵 With $290K in usable equity, they bought a $600K investment property in QLD

🔵 Rental yield is 5.2%, cash flow is neutral

🔵 After 3 years, the property has grown to $720K

🔵 They refinanced again, used new equity to buy Property #2

Today, they have two properties working for them—and they never touched their savings.

That’s what smart equity use looks like. No get-rich-quick hype—just strategy, patience, and confidence.

What Most People Get Wrong About Equity

Too many people:

❌ Assume equity = free money

❌ Forget to factor in holding costs

❌ Buy in the wrong location because “the bank said yes”

❌ Ignore how equity usage affects borrowing capacity

Here’s the truth:

Equity is powerful—but only when paired with education and a clear plan.

Your Next Step: Know Your Numbers. Then Build a Plan.

You might have more usable equity than you think.

But before you rush into anything:

🔵 Get a property valuation (not just an online estimate)

🔵 Speak with a mortgage strategist, not just a bank

🔵 Consider your long-term financial goals—not just the next 12 months

Final Word: Confidence Comes from Clarity

Equity can be a wealth accelerator, a retirement booster, a portfolio starter.

But only if you understand the mechanics and move with intention—not emotion.

If you're ready to take control of your equity and turn it into real, long-term wealth—don’t do it alone.

At Living Property, we help everyday Australians unlock their equity, manage risk, and grow with confidence. No fluff. Just smart strategy.

👉 Book a Free Discovery Call with our team, and let’s map out your next move.

You’ve worked hard to build that equity. Now let it work for you.

Start With An Obligation Free Consltation

Our Obligation Free Consultations are designed for you to ask us anything you like and start the process of uncovering a strategy suited to your circumstances.